Poker

Mastering the Game of Poker: From Beginner to Pro in No Time

Tips & Strategies

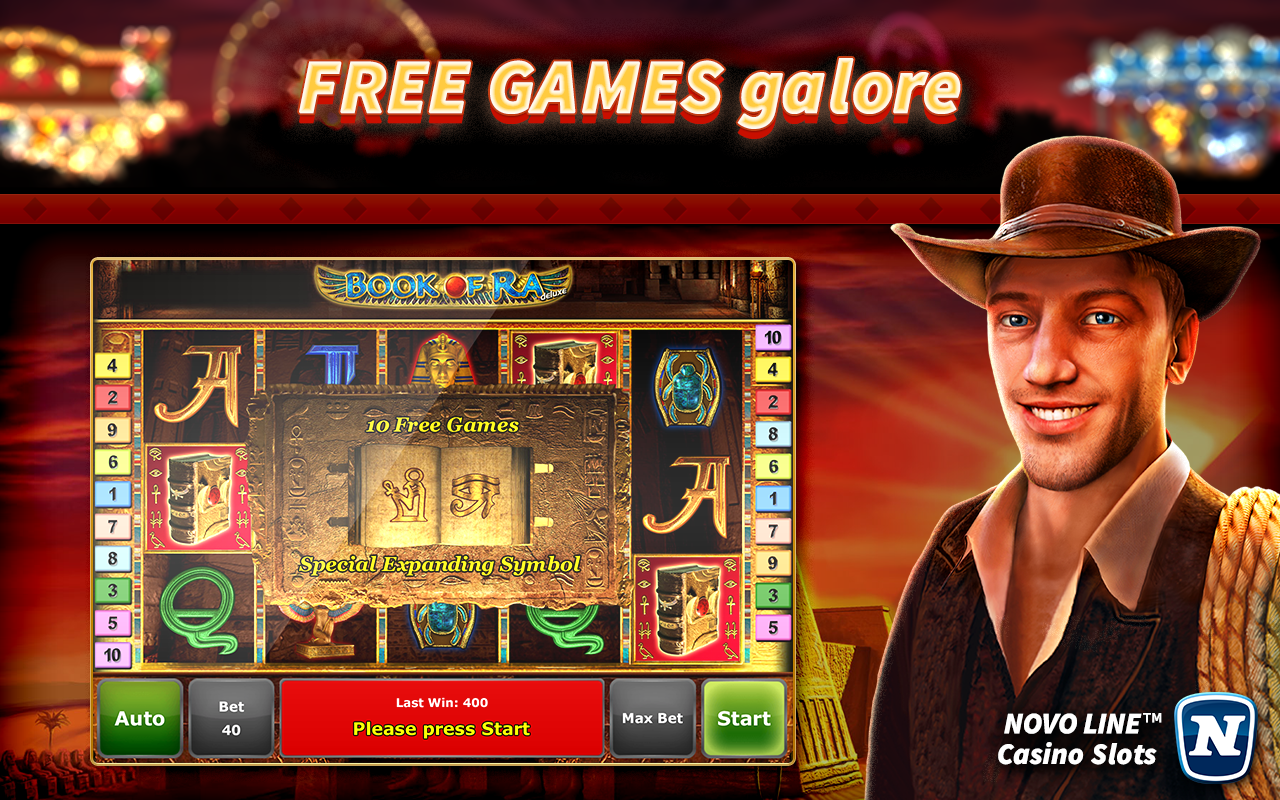

Navigating the World of Online Slots: Tips, Tricks and Strategies for Winning

Latest Posts

6 Tips to Help You Choose the Best Online Casino

The world of online gambling is vast and exciting, offering a plethora of options for players looking to try their luck and win big. However, with so many online casinos, it can take time to determine which ones are safe, reputable, and offer the best gaming experience. Whether you’re a seasoned gambler or just starting out, here are six tips to help you choose the best online pussy888apk casino and increase your chances of hitting the jackpot.

1. Research the Reputation

Before you start playing at any online casino, it’s essential to do your homework and research its reputation. Look for reviews from other players, check online forums, and visit reputable gambling review websites. Pay attention to factors such as the casino’s licensing, history of payouts, and overall customer satisfaction. By choosing a reputable and trustworthy online casino, you can ensure a fair and enjoyable gaming experience.

2. Check the Game Selection

One of the most important factors to consider when choosing an online casino is the variety and quality of games available. Look for a casino that offers a wide range of games, including slots, table games, live dealer games, and more. Additionally, check the software providers that power the games to ensure they are reputable and offer fair gameplay. A diverse selection of games will keep you entertained and give you more opportunities to win.

3. Evaluate the Bonuses and Promotions

Many online casinos offer enticing bonuses and promotions to attract new players and keep them coming back for more. Before you sign up, take the time to evaluate the bonuses offered, including welcome bonuses, free spins, and loyalty rewards. However, it’s essential to read the terms and conditions carefully, as some bonuses may come with wagering requirements or other restrictions. Choose a casino that offers generous bonuses with fair terms to maximize your winnings.

4. Consider Payment Options and Security

You’ll need to deposit and withdraw funds securely when playing at an online casino. Before you create an account, check the available payment options and ensure they are safe, convenient, and reliable. Look for casinos that offer a variety of payment methods, including credit/debit cards, e-wallets, and bank transfers. Additionally, prioritize casinos that use encryption technology to protect your personal and financial information from hackers and fraudsters.

5. Review Customer Support

In the world of online gambling, excellent customer support is crucial for resolving any issues or concerns that may arise. Before you start playing, test the casino’s customer support channels, such as live chat, email, and phone support. Reach out with any questions you may have and evaluate the response time and helpfulness of the support team. Choose a casino that offers prompt and responsive customer support to ensure a smooth gaming experience.

6. Check for Mobile Compatibility

With the increasing popularity of mobile gaming, choosing an online casino compatible with your mobile device is essential. Look for casinos that offer a mobile-friendly website or a dedicated mobile app that allows you to play your favorite games on the go. Mobile compatibility ensures that you can enjoy the thrill of online gambling anytime, anywhere, without being tied to a desktop computer.

By following these six tips, you can choose the best online casino for your needs and preferences, maximizing your chances of winning big and having a great time. Remember to gamble responsibly and set limits for yourself to ensure a fun gaming experience.

The Thrill Of Competition: Slot Tournaments Online

Slot tournaments have long been a favorite among casino enthusiasts, offering a unique blend of excitement and competition. In the realm of online gaming, they’ve become even more accessible and thrilling, with players worldwide competing for big wins and bragging rights. In places like online slot game Malaysia, these tournaments have gained immense popularity, drawing in players eager to test their luck and skill against others in the virtual arena.

The Concept of Slot Tournaments

Slot tournaments take the solitary experience of spinning the reels and turn it into a social and competitive event. Instead of playing against the house, participants compete against each other to rack up the highest score within a set time frame or number of spins. This adds an extra layer of excitement to the gameplay, as players strive to win and outperform their rivals.

How Slot Tournaments Work

In a typical slot tournament, players start with a fixed number of credits or a set amount of time to play. The goal is to accumulate as many points as possible by spinning the reels and achieving certain combinations. Points are awarded based on factors such as the size of the win, the frequency of wins, or hitting special bonus features. The player with the highest score at the end of the tournament emerges as the winner and receives a share of the prize pool.

Variety of Formats

Slot tournaments come in various formats to cater to different preferences and playing styles. Some tournaments have a predetermined duration, while others may run continuously with players joining and leaving at their leisure. Additionally, there are tournaments with fixed buy-ins and prize pools, as well as freerolls that allow players to participate at no cost.

Strategies for Success

While slot tournaments are largely games of chance, there are some strategies that players can employ to improve their chances of winning. These include managing your bankroll effectively, choosing the right games with favorable odds, and maximizing your playing time to increase your score. Additionally, staying informed about tournament rules and bonus features can give you an edge over the competition.

The Allure of Big Wins

One of the biggest draws of slot tournaments is the potential for significant payouts. With prize pools often reaching thousands or even millions of dollars, the allure of striking it rich can be irresistible. Moreover, the competitive aspect adds an extra thrill to the experience, making every spin feel like a shot at glory.

Join the Action Today

Whether you’re a seasoned slot enthusiast or a newcomer looking for some excitement, slot tournaments offer a unique and exhilarating gaming experience. With their blend of competition, strategy, and big wins, they’re sure to keep you entertained for hours on end. So why wait? Join the action today and see if you have what it takes to emerge victorious in online slot tournaments.

A Guide To Navigating Online Casino Payments

In the realm of digital gambling, the best USA online casino is not only defined by its thrilling games and enticing bonuses but also by its seamless payment systems. For both novice players and seasoned veterans, understanding the intricacies of online casino payments is essential for a smooth and enjoyable gaming experience.

Choosing the Right Payment Method

Selecting the optimal payment method is the first step in your online casino journey. With a myriad of options available, ranging from credit cards to e-wallets and cryptocurrencies, it’s crucial to consider factors such as security, speed, and convenience. While credit and debit cards remain popular choices due to their widespread acceptance, e-wallets like PayPal and Neteller offer added layers of security and faster transactions. Cryptocurrencies such as Bitcoin are gaining traction for their anonymity and decentralized nature.

Security Measures: Protecting Your Funds

When engaging in online gambling, safeguarding your financial information should be a top priority. Reputable online casinos employ state-of-the-art encryption technology to ensure the confidentiality of your personal and financial data. Look for sites with SSL (Secure Sockets Layer) certification and additional security protocols to mitigate the risk of fraud and unauthorized access.

Understanding Deposit and Withdrawal Processes

Before making your first deposit, familiarize yourself with the casino’s deposit and withdrawal procedures. While deposits are typically instantaneous, withdrawals may involve processing times and withdrawal limits. Be sure to read the terms and conditions carefully to avoid any unexpected delays or fees. Additionally, verify whether the casino supports your preferred currency to avoid currency conversion charges.

Bonuses and Promotions: Maximizing Your Returns

Many online casinos offer enticing bonuses and promotions to attract new players and retain existing ones. These may include welcome bonuses, deposit matches, free spins, and loyalty rewards. However, it’s essential to understand the terms and conditions attached to these offers, including wagering requirements and withdrawal restrictions. By leveraging bonuses strategically, you can enhance your gaming experience and potentially increase your winnings.

Mobile Payments: Gaming on the Go

With the rise of mobile gaming, the convenience of making payments on the go has become paramount. Mobile payment methods such as Apple Pay and Google Pay allow players to fund their accounts seamlessly using their smartphones or tablets. Additionally, some online casinos offer dedicated mobile apps with integrated payment functionalities for a streamlined gaming experience.

Seeking Reliable Customer Support

In the event of any payment-related issues or inquiries, reliable customer support is indispensable. Choose online casinos with responsive customer service channels, including live chat, email, and phone support. Prompt assistance can help resolve payment disputes, address technical glitches, and provide peace of mind throughout your gaming journey.

Conclusion

Navigating the world of online casino payments requires careful consideration of various factors, including payment methods, security measures, bonus offers, and customer support. By choosing reputable casinos and understanding the intricacies of payment processes, you can enjoy a safe, seamless, and rewarding gaming experience.

Mobile Sports Betting: Revolutionizing the Game for Bettors

In today’s fast-paced world, technology redefines how we engage with various aspects of our lives, including entertainment and leisure activities. One area that has seen a significant transformation is sports betting, with the emergence of mobile platforms offering unprecedented convenience and accessibility to enthusiasts worldwide. Specifically, betting in Malaysia has undergone a notable evolution, as local and international players alike can now participate in sports betting through mobile platforms. With the advent of mobile sports betting, enthusiasts in Malaysia and around the globe can now place wagers anytime, anywhere, directly from the palm of their hands, revolutionizing the way they engage with their favorite sports and teams.

Convenience at Your Fingertips

Gone are the days when sports betting required a trip to a physical bookmaker or logging onto a computer to place a bet. With the rise of mobile sports betting platforms, enthusiasts can now access a wide range of betting markets and options instantly, using their smartphones or tablets. This level of convenience has eliminated geographical barriers and time constraints, allowing bettors to engage in wagering activities with unparalleled ease and flexibility. Whether you’re at home, commuting, or attending a live sporting event, the ability to place bets on-the-go has transformed the betting experience for enthusiasts around the globe.

Expansive Betting Markets

Mobile sports betting platforms offer a diverse range of betting markets, catering to the preferences of bettors with varying interests and expertise. From traditional sports like football, basketball, and horse racing to niche markets such as esports and virtual sports, there’s something for everyone to wager on. Moreover, these platforms provide a plethora of betting options, including straight bets, parlays, prop bets, and live betting, enhancing the excitement and engagement for bettors. With a few taps on their mobile devices, enthusiasts can explore an extensive array of betting opportunities and tailor their wagering strategies according to their preferences and insights.

Real-Time Updates and Insights

One of the most compelling features of mobile sports betting is the access to real-time updates and insights, empowering bettors with valuable information to make informed decisions. Through live scores, statistics, and analysis, enthusiasts can stay abreast of the latest developments in ongoing matches and events, allowing them to adjust their bets or capitalize on emerging opportunities swiftly. Additionally, many mobile betting platforms offer expert commentary, tips, and predictions from seasoned analysts and insiders, further enriching the betting experience and enabling bettors to refine their strategies based on expert insights.

Enhanced Security and Privacy

Security and privacy are paramount for any online activity, and mobile sports betting is no exception. Leading mobile betting platforms employ state-of-the-art encryption technology and robust security protocols to safeguard their users’ personal and financial information. With secure payment options and stringent verification procedures, bettors can have peace of mind knowing that their transactions and data are protected from unauthorized access and fraudulent activities. Furthermore, reputable betting operators adhere to strict regulatory standards and undergo regular audits to ensure fair play and transparency, fostering trust and confidence among bettors.

Social Interaction and Community Engagement

Mobile sports betting has also fostered a vibrant community of enthusiasts who share a passion for sports and wagering. Through social features such as chat rooms, forums, and social media integration, bettors can connect with like-minded individuals, discuss betting strategies, and share insights and experiences in real-time. This sense of camaraderie and community adds an extra layer of enjoyment to the betting experience, allowing bettors to engage in friendly competition, celebrate victories, and commiserate losses together. Moreover, some mobile betting platforms offer exclusive promotions, rewards, and loyalty programs to incentivize social interaction and foster a sense of belonging among their users.

Conclusion

In conclusion, mobile sports betting has emerged as a game-changer for enthusiasts, offering unprecedented convenience, accessibility, and engagement opportunities. Whether you’re a seasoned bettor or a casual fan looking to spice up your sports viewing experience, mobile betting platforms provide a user-friendly and immersive environment to indulge your passion for sports and wagering. With a diverse range of betting markets, real-time updates, enhanced security measures, and social interaction features, mobile sports betting has truly revolutionized the way we engage with sports and betting. So why wait? Download your favorite mobile betting app today and join the excitement of mobile sports betting!

From Chips To Cryptos: The Evolution of Online Casino Payments

Online casinos have come a long way since their inception, offering a dynamic and immersive gaming experience to players around the world. One aspect of this evolution that often goes unnoticed but is of paramount importance is the transformation of payment methods. From traditional casino chips to the rise of cryptocurrencies, the world of online casino payments has witnessed a fascinating journey. In this article, we will explore the changing landscape of online casino payments, from its humble beginnings to the cutting-edge integration of cryptocurrencies. Additionally, we will introduce you to an emerging online casino platform known as “pussy88.”

The Early Days of Casino Payments

1. Cash and Chips

In the early days of online casinos, players primarily used cash and casino chips for their transactions. This mirrored the traditional brick-and-mortar casino experience, where patrons exchanged cash for chips to place bets. However, this method had its limitations, as it required physical presence and involved handling physical currency.

2. Introduction of Digital Payments

As online casinos gained popularity, the need for more accessible payment methods became evident. This led to the introduction of digital payment options such as credit cards, debit cards, and electronic wallets like PayPal and Neteller. These methods offered convenience and security, making it easier for players to fund their accounts and withdraw their winnings.

The Revolution of Cryptocurrencies

3. Emergence of Cryptocurrencies

In recent years, cryptocurrencies have emerged as a revolutionary force in the online casino industry. Bitcoin, Ethereum, and other digital currencies have paved the way for faster, more secure, and more private transactions. These cryptocurrencies operate on blockchain technology, providing transparency and reducing the risk of fraud.

4. Benefits of Cryptocurrency Payments

Cryptocurrencies have brought several advantages to online casino payments:

- Anonymity: Cryptocurrency transactions offer a higher level of privacy, as they do not require players to disclose personal information.

- Speed: Cryptocurrency transactions are processed quickly, allowing players to access their funds almost instantly.

- Security: The blockchain technology behind cryptocurrencies enhances the security of transactions, making them highly resistant to hacking and fraud.

- Global Accessibility: Cryptocurrencies transcend international borders, enabling players from around the world to participate in online gambling without worrying about currency exchange rates or restrictions.

5. Integration of Cryptocurrencies in Online Casinos

Many online casinos have embraced cryptocurrencies, allowing players to deposit and withdraw funds using digital currencies. This integration has opened up new possibilities for players, enabling them to enjoy the benefits of crypto while playing their favorite casino games. Platforms like “pussy88” have also adopted cryptocurrencies, providing a seamless and secure gaming experience for crypto enthusiasts.

The Future of Online Casino Payments

As technology continues to advance, the evolution of online casino payments is far from over. Here are some potential developments we can expect in the future:

6. Wider Adoption of Cryptocurrencies

Cryptocurrencies are likely to become even more mainstream in the online casino industry, with more casinos accepting a broader range of digital currencies.

7. Enhanced Security Measures

Online casinos will continue to invest in cutting-edge security measures to protect players’ funds and personal information, further ensuring a safe gaming environment.

8. Integration of New Payment Technologies

Emerging payment technologies such as blockchain-based smart contracts and decentralized finance (DeFi) could play a significant role in shaping the future of online casino payments.

In conclusion, the evolution of online casino payments from cash and chips to the integration of cryptocurrencies represents a significant leap in the industry’s progress. The convenience, security, and privacy offered by cryptocurrencies have revolutionized the way players engage in online gambling. As we look ahead, it’s clear that the world of online casino payments will continue to evolve, providing players with even more options and opportunities to enjoy their favorite games. And if you’re interested in exploring this dynamic landscape, don’t forget to check out “pussy88,” where you can experience the future of online casino payments firsthand.

Playing Smart: The Top Strategies for Ethereum Casino Gaming

In the ever-evolving world of online gambling, Ethereum casinos have become a popular choice for players seeking transparency, security, and fast transactions. The decentralized nature of Ethereum, coupled with its smart contract functionality, provides a unique and innovative gaming experience. Whether you are a seasoned gambler or a newcomer to the scene, mastering the art of playing smart in Ethereum casinos can significantly enhance your chances of success. Let’s explore the top strategies to elevate your Ethereum casino gaming experience.

1. Choose Wisely: Selecting the Best Ethereum Casino Sites

The foundation of a successful Ethereum casino journey begins with choosing the right platform. To ensure a secure and fair gaming environment, it’s crucial to opt for reputable and trustworthy Ethereum casino sites. A quick search for suggested Ethereum casino sites can yield valuable insights into platforms that prioritize user safety, offer a diverse game selection, and provide enticing bonuses. Explore user reviews and expert recommendations to make an informed decision before diving into the world of Ethereum gambling.

2. Leverage Smart Contracts: Enhancing Security and Fairness

One of the key advantages of Ethereum casinos is the integration of smart contracts, which automatically execute and enforce the game’s rules. This technology enhances security by eliminating the need for intermediaries and reducing the risk of fraud. Players can trust that the outcomes are tamper-proof and fair, giving them confidence in the gaming process. Please familiarize yourself with how smart contracts work to maximize the benefits they bring to the table.

3. Diversify Your Game Portfolio: Explore the Variety

Ethereum casinos offer a diverse range of games beyond traditional casino classics. From decentralized poker and roulette to innovative blockchain-based slots, many options exist. Diversifying your game portfolio adds excitement to your gaming sessions and opens up new avenues for potential winnings. Be open to trying different games and strategies to find what suits your preferences and playing style.

4. Stay Informed: Keep Abreast of Market Trends

The world of cryptocurrency and blockchain technology is dynamic, with constant advancements and changes. To play smart in Ethereum casinos, stay informed about market trends, new game releases, and any updates to the Ethereum network. Knowledge of the latest developments will empower you to adapt your strategies accordingly and stay ahead in the ever-evolving landscape of online gambling.

5. Practice Responsible Gambling: Set Limits and Stick to Them

Regardless of the platform, responsible gambling is paramount. Set clear limits on your deposits, losses, and playing time before engaging in Ethereum casino gaming. This ensures a more enjoyable experience and mitigates the risk of excessive losses. Treat gambling as a form of entertainment, and always prioritize responsible behavior to maintain a healthy and sustainable gaming lifestyle.

6. Capitalize on Bonuses and Promotions: Boost Your Bankroll

Ethereum casinos often entice players with attractive bonuses and promotions. Take advantage of these offers to boost your bankroll and extend your playing time. However, read and understand the terms and conditions associated with bonuses to make the most of these opportunities. Bonuses can significantly enhance your chances of winning without risking additional funds.

7. Engage with the Community: Learn from Others

Joining the Ethereum casino community can be a valuable asset in your gaming journey. Participate in forums, chat groups, and social media discussions to learn from other players’ experiences. Sharing insights, strategies, and tips can provide a fresh perspective and help you refine your approach to Ethereum casino gaming.

8. Embrace Innovation: Be Open to New Technologies

As the Ethereum ecosystem evolves, new technologies and features may be introduced to enhance the gaming experience. Stay open to embracing innovation, whether it’s in the form of gamification, virtual reality integration, or other cutting-edge developments. Being adaptable to new technologies can give you a competitive edge and make your Ethereum casino gaming experience even more thrilling.

Roll The Dice Anywhere: Exploring the Best Casino Apps for Every Game

In a world where technology is at our fingertips, the thrill of casino games has shifted from traditional brick-and-mortar establishments to the convenience of mobile devices. Casino enthusiasts can now experience the excitement of slots, poker, and various other games right from the palm of their hands. With many options available, let’s dive into the realm of casino app and explore the best ones for every game.

1. The Allure of Slots: Spin and Win on the Go

Casino apps have revolutionized the way we play slots. Gone are the days of pulling a lever; now, a simple tap on your device unleashes a world of spinning reels and potential jackpots. Top-rated casino apps offer diverse slot games, from classic fruit machines to immersive video slots with captivating themes. Whether you’re a casual player or a seasoned slot enthusiast, these apps provide an unparalleled gaming experience.

2. Poker in Your Pocket: Master the Cards Anytime, Anywhere

For poker fans, the evolution of casino apps has brought the beloved card game to new heights. Engage in Texas Hold’em, Omaha, or other popular variants against real or AI opponents. The best casino apps for poker offer a seamless interface and ensure fair play and secure transactions. Sharpen your poker skills and participate in tournaments with just a few taps on your smartphone.

3. Blackjack Bliss: Hit or Stand on the Go

Blackjack enthusiasts can rejoice as casino apps deliver the thrill of this classic card game to their mobile devices. Experience the excitement of trying to beat the dealer, strategizing your moves, and aiming for that elusive 21. The top casino apps for blackjack offer realistic graphics, smooth gameplay, and various table limits to cater to beginners and high rollers.

4. Roulette: Spin the Wheel Virtually Anywhere

The iconic roulette wheel has found a new home in casino apps, allowing players to place their bets and watch the wheel spin from anywhere in the world. Whether you prefer European, American, or French roulette, these apps recreate the casino ambiance with realistic sound effects and animations. Enjoy the game’s simplicity or implement advanced strategies – the choice is yours.

5. Craps on the Go: Roll the Dice in the Palm of Your Hand

Casino apps have not overlooked the excitement of craps, the dice game that has been captivating players for generations. Roll the virtual dice, place your bets, and feel the adrenaline rush as you anticipate the outcome. The best casino apps for craps offer an immersive experience with intuitive controls and detailed graphics, ensuring an authentic gaming experience.

6. Baccarat Brilliance: Punto Banco in Your Pocket

Casino apps have made the elegant game of baccarat accessible to players worldwide. Experience the sophistication of Punto Banco or other baccarat variations with a few taps on your device. These apps capture the essence of the game and provide a user-friendly interface for beginners and seasoned players.

7. Specialty Games: More Than Just Cards and Dice

Beyond the classic casino games, many casino apps offer a variety of specialty games. From keno and scratch cards to virtual sports and arcade-style games, there’s something for everyone. These unique options provide a refreshing break from traditional casino games and showcase the versatility of casino apps.

8. Live Dealer Games: Bringing the Casino to You

For those craving the authenticity of a land-based casino, the best casino apps now feature live dealer games. Interact with real dealers, chat with other players, and enjoy the immersive experience of live blackjack, roulette, baccarat, and more. Integrating live dealer games adds a social element to mobile gaming, bridging the gap between virtual and real-world casino experiences.

In conclusion, the world of casino apps offers diverse gaming options, from classic slots to live dealer experiences. As technology advances, these apps are set to redefine the landscape of online gambling, providing a convenient and thrilling way to enjoy casino games anytime, anywhere.

From Bitcoin To The Casino Floor: Understanding Cryptocurrency Payments

Cryptocurrency has become a ubiquitous term in the realm of finance and technology, transforming the way we perceive and conduct transactions. The rise of Bitcoin and other digital currencies has paved the way for innovative payment solutions that extend beyond conventional banking systems. According to outlookindia, this shift in the financial landscape has even reached the vibrant and dynamic world of casino gaming.

The Cryptocurrency Revolution

In recent years, cryptocurrencies have gained immense popularity as decentralized and secure forms of digital currency. The blockchain technology that underpins cryptocurrencies ensures transparency and immutability, making them attractive for various applications. As the world embraces this financial revolution, businesses across industries are exploring the integration of cryptocurrency payments.

Breaking Down the Basics

To comprehend the impact of cryptocurrency payments on the casino floor, it’s essential to grasp the basics of how these digital currencies function. Unlike traditional currencies issued by governments, cryptocurrencies operate on a decentralized network of computers, utilizing cryptography to secure transactions. Bitcoin, the pioneer in this space, introduced the concept of a peer-to-peer electronic cash system, revolutionizing the way we transfer value.

Enhanced Security Measures

One of the key advantages of utilizing cryptocurrencies in casino transactions is their heightened security level. Traditional payment methods may expose users to potential fraud or identity theft, but cryptocurrencies rely on robust cryptographic techniques to secure transactions. This has made them an attractive option for those seeking enhanced privacy and security in their financial dealings on and off the casino floor.

Cryptocurrency Payments in Casinos

As the world of finance evolves, the casino industry is still catching up in adopting innovative payment solutions. Many online and physical casinos now accept various cryptocurrencies, providing patrons with an alternative to traditional payment methods. This shift is not merely a trend; it represents a strategic move to cater to a growing demographic of cryptocurrency enthusiasts.

Benefits for Casino Enthusiasts

For avid casino enthusiasts, the integration of cryptocurrency payments brings several benefits. Faster transaction processing, reduced fees, and increased privacy are among the advantages that make cryptocurrency transactions an appealing option for those engaging in casino gaming. The borderless nature of cryptocurrencies further facilitates international transactions, opening up new possibilities for players worldwide.

Challenges and Regulation

While the adoption of cryptocurrency payments in casinos presents exciting prospects, it also comes with its set of challenges. Regulatory uncertainties and concerns about potential misuse have prompted authorities to evaluate and establish guidelines for the integration of cryptocurrencies in the gaming industry. Striking a balance between innovation and responsible use remains a crucial aspect of this ongoing transformation.

Looking Ahead

The journey from Bitcoin to the casino floor indicates the broader shift towards a digital and decentralized financial landscape. Cryptocurrency payments are reshaping industries, challenging traditional norms, and providing individuals with newfound financial autonomy. As technology continues to advance, the integration of cryptocurrencies in various sectors, including gaming, is likely to evolve, offering exciting opportunities for both businesses and consumers.

The Slot Game Symphony: Sound Effects and Immersion

Slot games have come a long way from their humble beginnings, evolving into a symphony of entertainment that engages players on multiple sensory levels. Among the elements contributing to this immersive experience, the often-overlooked hero is the sound effects. In this exploration, we delve into the world of slot games and the harmonious role sound effects play in creating an environment where excitement meets opportunity.

The Initial Spin: Introducing the Melody of Possibilities

As players embark on their slot journey, the first spin sets the tone for the entire experience. The anticipation builds, and the slot machine comes to life with a cacophony of sounds, each contributing to the creation of an atmosphere filled with promise.

Rhythmic Reels: Syncing Symbols with Sound

The visual spectacle of spinning reels is complemented by a carefully orchestrated soundtrack. Each symbol landing on the reels is accompanied by a unique sound, creating a symphony that resonates with the theme of the game. The rhythmic dance of symbols and sounds enhances the player’s connection with the narrative, making every win or near miss a memorable experience.

Bonus Rounds: Elevating Excitement with Audio Accolades

Entering the realm of bonus rounds is akin to stepping into the crescendo of a musical composition. The intensity of the game heightens, and the accompanying sound effects amplify the excitement. From celebratory tunes for big wins to suspenseful notes during free spins, the audio elements enrich the gameplay, making every bonus round an auditory adventure.

Immersive Themes: Crafting Soundscapes for Every Story

slotuntung games often feature diverse themes, from ancient civilizations to futuristic worlds. Sound designers play a pivotal role in creating immersive soundscapes that transport players to these thematic realms. The sound effects become a storytelling tool, enhancing the narrative and making the gaming experience more than just a series of spins.

Interactive Engagement: Player Decisions and Audio Feedback

Modern slot games incorporate interactive elements that respond to player decisions. The incorporation of skill-based features or interactive bonus games is accompanied by dynamic sound effects that provide immediate feedback. This real-time audio engagement heightens the player’s sense of agency and involvement in the game.

The Evolution of Technology: From Ding-Ding to Surround Sound

Advancements in technology have significantly influenced the auditory dimension of slot games. What once relied on simple bells and mechanical sounds has evolved into a sophisticated symphony of digital audio. Surround sound systems and high-quality speakers transport players into a realm where the distinction between the virtual and the real blurs.

Social Gaming: Syncing Sounds for Shared Experiences

The rise of social gaming brings a communal aspect to slot experiences. Shared soundscapes enhance the sense of togetherness, whether players are physically present or connected through online platforms. The synchronized sounds create a shared atmosphere, turning the solitary act of playing into a social event.

In conclusion, the slot game symphony is a testament to the artistry of sound design in the gaming industry. The marriage of visual aesthetics with carefully crafted audio elements elevates slot games beyond mere chance-based activities. As players continue to spin the reels, they partake in a symphony of excitement, guided by the harmonious interplay of sound effects that make every spin an auditory adventure.

Ensuring Fair Play: The Technology Behind Top Real-Money Blackjack Games

In the dynamic realm of online casinos, where lines of code replace the shuffle of cards, players often wonder about the fairness of virtual blackjack games. The virtual domain brings both convenience and skepticism, but behind the scenes, sophisticated algorithms are at play to guarantee fairness and maintain the integrity of top real-money blackjack games.

1. The Role of Random Number Generators (RNGs)

Random Number Generators are at the core of online blackjack’s fairness. These complex algorithms generate unpredictable sequences of numbers, replicating the randomness of a shuffled physical deck. In the context of top real-money blackjack games, RNGs ensure that every card dealt results from pure chance, mirroring the unpredictability of a traditional casino setting.

2. Shuffling Simulations: Beyond Physical Constraints

Traditional blackjack involves meticulous shuffling of decks to prevent card counting and ensure fairness. Online platforms simulate this process through advanced algorithms that replicate the randomness and unpredictability of manual shuffling. Top real-money blackjack games utilize these algorithms to guarantee that each hand is a unique combination of cards, offering players a genuine and unbiased gaming experience.

3. Transparency through Algorithmic Audits

To maintain trust among players, reputable online casinos subject their algorithms to regular audits by independent third-party organizations. These audits assess the fairness of the algorithms and ensure that they meet industry standards. Players engaging in top real-money blackjack games can find reassurance in the transparency these audits provide, knowing that the algorithms governing the games are scrutinized for fairness.

4. Anti-Cheating Mechanisms

Online casinos employ sophisticated anti-cheating mechanisms to detect any irregularities in gameplay. These mechanisms are designed to identify patterns that may indicate cheating or manipulation. In the context of top real-money blackjack games, these measures prevent any attempts to exploit the system, maintaining a level playing field for all participants.

5. Fair Distribution of Cards: Ensuring Equal Opportunities

In the quest for fairness, online blackjack algorithms are programmed to ensure an equitable distribution of cards. This means that every player participating in top real-money blackjack games has an equal chance of receiving favorable hands. The algorithms work tirelessly to eliminate biases, creating an environment where luck and skill are the primary determinants of success.

6. Continuous Improvement through Machine Learning

The world of technology is ever-evolving, and online blackjack platforms continually leverage machine learning to enhance their algorithms. These systems adapt and evolve by analyzing vast amounts of data, becoming more adept at ensuring fairness in top real-money blackjack games. This commitment to improvement demonstrates the dedication of online casinos to providing a secure and trustworthy gaming experience.

7. Encryption for Data Security

Beyond fairness in gameplay, top real-money blackjack games prioritize the security of players’ sensitive information. Robust encryption protocols safeguard financial transactions and personal details, creating a secure user environment. This dual focus on fairness and security ensures that players can confidently enjoy online blackjack.

In conclusion, the technology behind top real-money blackjack games is a sophisticated amalgamation of RNGs, shuffling simulations, audits, anti-cheating measures, and continuous improvement through machine learning. As players engage in the excitement of virtual blackjack, they can rest assured that the algorithms governing these games are designed with fairness, transparency, and security in mind.